The Central Bank of Uzbekistan has increased its gold reserves for the first time since July, as reported by the World Gold Council.

In November, net gold purchases by global central banks amounted to 53 tons, according to available data. The WGC emphasizes that this is a continuation of the trend observed throughout 2024, where regulators have been active buyers of the precious metal. Additionally, the decline in prices amid the U.S. presidential elections may have served as an extra incentive for gold accumulation.

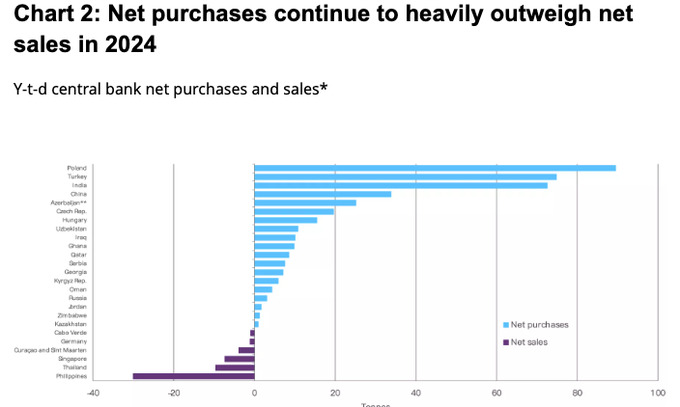

Specifically, the National Bank of Poland increased its gold reserves by 21 tons, bringing the total to 448 tons. Warsaw remains the largest buyer of the precious metal with a total of 90 tons.

The Central Bank of Uzbekistan purchased 9 tons of gold in November, marking the first increase in gold reserves since summer. Annual net purchases totaled 11 tons, raising the gold reserve to 382 tons.

Photo: World Gold Council

The Reserve Bank of India ranked third with 8 tons (73 tons annually). Following them were Kazakhstan and China with 5 tons each, Jordan with 4 tons, Turkey with 3 tons, the Czech Republic with 2 tons, and Ghana with 1 ton. Singapore emerged as the largest seller of the precious metal with 5 tons.

As of December 1, Uzbekistan's international reserves amounted to $41.47 billion, which is $1.67 billion less than the previous month. The depreciation of gold reserves and the reduction of the currency portion of reserves led to a decrease in the country's gold and foreign exchange reserves for the first time since March.

Earlier, Spot reported that the dollar exchange rate at several commercial banks reached 13,000 sums.